GST- Goods and Services Tax

It was Ms.Indira Gandhi, who added the word Socialism to the preamble of the constitution through 42nd amendment and it was Mr. Narsimha Rao who introduced globalisation and liberalisation in India. Thus, he killed the spirit of socialism. In this way, the Indian polity was tilted in favour of the rich and the capitalist. Thus, socialism was buried deep in the earth, though it is still a part of the preamble of the Indian constitution.

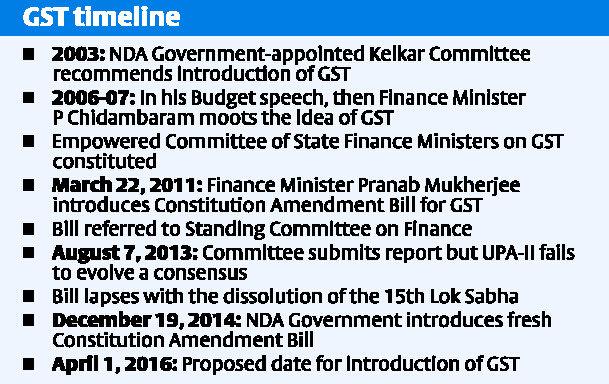

Continuing the process of globalization and liberalization, the Indian government prepared several schemes to help corporate houses to amass more wealth and money at the cost of the poor. One of them is GST. Under the pressure of the USA, the Indian government introduced it in the parliament on 19th December 2014, but it could not be passed because of the opposition of the congress and the leftist. It was sent to the select committee and remained stuck there for a long time. Now it has been passed not only by Lok Sabha, but also by Rajya Sabha after certain amendments. This has been possible after great persuasion and wooing on the part of the Prime Minister Narendra Modi and the Finance Minister Mr. Arun Jaitley. The success of GST bill depended on the support of opposition, specially the congress. Now, the effect of American influence on the Indian economy that began with the introduction of globalization and liberalization is going to be complete with GST. In other words, now India is under the subjugation of America both politically and economically.

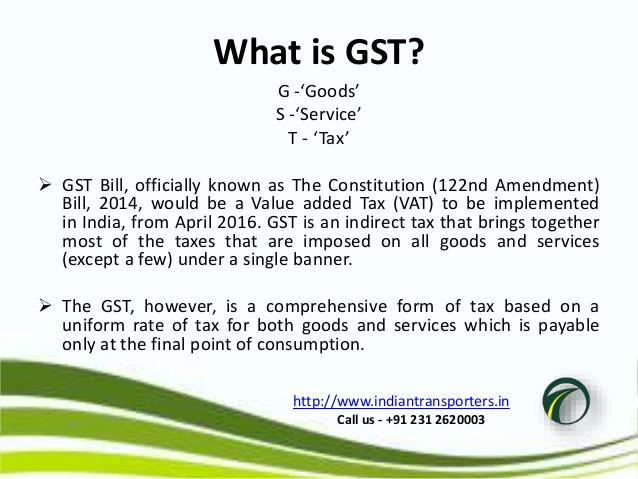

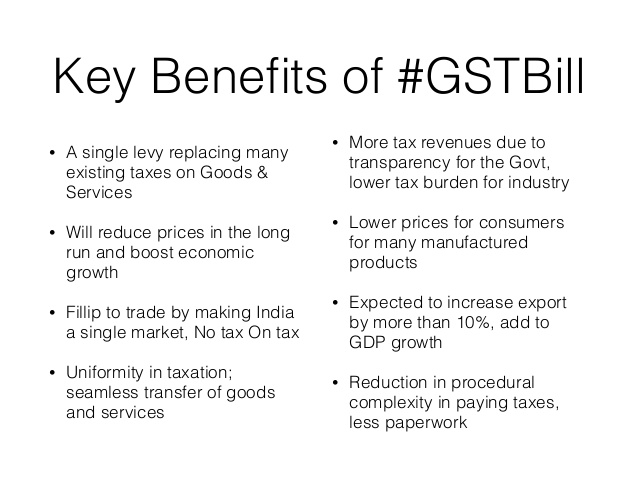

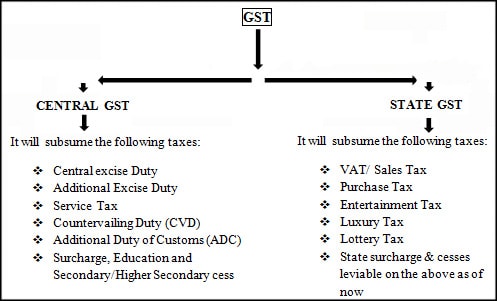

With the introduction of GST, Indian taxation system will be deeply affected. The taxes imposed at various levels of the production of goods will be combined and only one tax will be imposed on different items. It may be 18% or 27%. It is still undecided. Consequently, the prices of goods will rise or fall. There are various items, specially the items used by the poor’s, such as the tea, coffee, salts, ready made clothes and many other food items, whose prices will rise. There are various items, used specially by the rich such as TV, refrigerators, luxury cars, whose prices will fall. What does this show? It shows the governments tilt towards the rich. The rich will be richer and the poor will be poorer. Also Read: Demonetisation

This is the worst type of the capitalism. The middle class will be eliminated. There will be only two classes- the rich and the poor. This will give birth to social tension which will be compounded by communal and caste tensions. As a result, there will be unrest and riots. The social fabric of our society will be torn to pieces and there will be great upheaval in our country. The government should consider these points seriously before introducing the new taxation policy. It should introduce GST with necessary changes as safety valves to prevent these problems and thus maintain peace and normalcy in the country.

Also Read; Work culture in India – The AARAM culture

ZYbmFP In fact no matter if someone doesn at be aware of afterward its up

Some truly wonderful blog posts on this website , thanks for contribution.

Wow! Thank you! I constantly needed to write on my website something like that. Can I take a part of your post to my website?

keep up the superb piece of work, I read few articles on this web site and I think that your blog is rattling interesting and has got bands of fantastic information.

Really appreciate you sharing this article.Really looking forward to read more. Really Cool.

Very informative blog post.Thanks Again. Fantastic.

Money and freedom is the greatest way to change, may you be rich and continue

Please let me know where you got your theme. Bless you

may you be rich and continue to guide other people.

It as not that I want to copy your web page, but I really like the design and style. Could you let me know which style are you using? Or was it tailor made?

know what you are talking about! Bookmarked. Kindly also seek

You ave an extremely good layout for your blog i want it to use on my internet site also.

Muchos Gracias for your post.Much thanks again. Want more.

This is one awesome article post.Thanks Again. Really Great.

Way cool! Some extremely valid points! I appreciate you writing this post and the rest of the site is also really good.

I simply could not leave your web site prior to suggesting that I really enjoyed the usual information a person supply in your guests? Is gonna be again steadily to investigate cross-check new posts

There is definately a great deal to find out about this topic. I love all the points you made.

This excellent website truly has all the information I needed concerning this subject and didn at know who to ask.

Major thankies for the article post.Really looking forward to read more. Awesome.

Many thanks for sharing this good post. Very interesting ideas! (as always, btw)

Very good write-up. I definitely appreciate this website. Thanks!

Really appreciate you sharing this article post.Really looking forward to read more.

Very good information. Lucky me I recently found your site by chance (stumbleupon). I ave book marked it for later!

It as hard to find educated people in this particular topic, but you seem like you know what you are talking about! Thanks

Your site provided us with valuable info to work on. You ave done a

This was novel. I wish I could read every post, but i have to go back to work now But I all return.

Thanks for the good writeup. It actually was a enjoyment account it. Glance advanced to more brought agreeable from you! However, how can we be in contact?